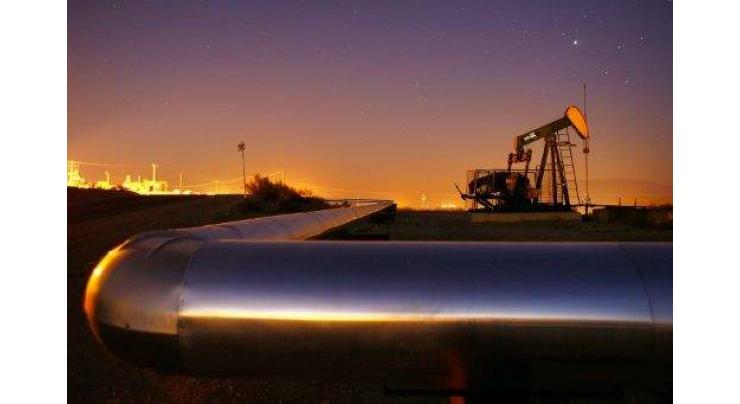

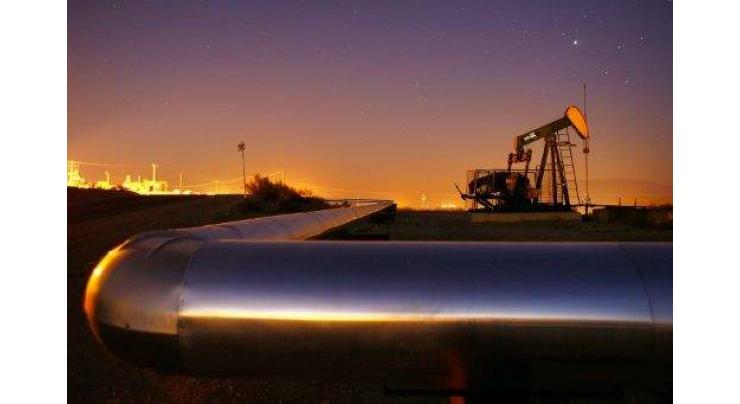

Energy Firms Lead Asia Markets Down After Oil Plunge, Dollar Up

Umer Jamshaid Published March 09, 2017 | 08:41 AM

HONG KONG, March 9, (APP - UrduPoint / Pakistan Point News - 09th Mar, 2017 ) - Energy firms led a broad sell-off in Asian markets Thursday following a five percent plunge in oil prices, but the Dollar held on to gains after a surprisingly strong US jobs report.

Wall Street suffered another loss after a closely watched report showed a shock surge in US oil inventories that rekindled worries about a global supply glut that has hammered the crude market since mid-2014.

The Energy Department revealed a whopping eight million barrel increase in supplies over the past week -- four times more than expected -- owing to higher domestic production and increased stockpiling.

The news battered the oil market, with both main contracts slumping more than five percent to lows not seen since the end of last year. Jeffrey Halley, senior market analyst at OANDA, said the report was the "straw that broke the camel's back", with concerns already abound that Russia was not pulling its weight on much-vaunted production cuts agreed between OPEC and non-OPEC countries in November.

And Greg McKenna, chief market strategist at AxiTrader, said there is growing unease that too much of the burden on reducing output is being shouldered by OPEC nations, particularly kingpin Saudi Arabia.

"If they lose patience, oil -- and the bulls -- could crack wide open," he warned. While oil edged back up Thursday, Asian energy firms took the heat in early exchanges.

Japan's Inpex shed 1.5 percent, Hong Kong-listed PetroChina and CNOOC were each around two percent down and Woodside Petroleum dived 1.8 percent in Sydney.

That in turn hit wider markets, with Hong Kong down more than one percent and Shanghai 0.8 percent off, with traders brushing off another jump in China's factory gate prices that indicate a return to inflation in the country.

Sydney fell 0.4 percent and Seoul was 0.1 percent off and Singapore slipped 0.7 percent. Taipei dived more than one percent. The oil figures overshadowed a surprise jump in private jobs creation in the US, which beefed up expectations for Friday's key government jobs report and reinforced expectations the Federal Reserve will hike interest rates next week.

That in turn fired a rally in the dollar, which peaked close to 115 Yen Wednesday before paring the gains, with traders still uncertain as President Donald Trump has provided little detail on his plans to ramp up infrastructure spending and cut taxes.

Also acting as a weight on further dollar gains are concerns about upcoming elections in France and the Netherlands as well as geopolitical crises including North Korea's recent missile test. The euro dipped ahead of a closely watched policy meeting by the European Central Bank later in the day.

Related Topics

Recent Stories

Saka and Odegaard start for Arsenal, Guerreiro in Bayern midfield

Qatar PM says re-evaluating Israel-Hamas mediation role

Govt spokesperson terms allegations of PTI's Marwat against Saudi Arabia 'heinou ..

Minister appreciate UAE’s support for Pakistan economic challenges

Manchester City v Real Madrid Champions League starting line-ups

MIGA's support Pakistan in attracting foreign investments: Federal Minister for ..

Walker returns to captain Man City for Real Madrid clash

Action taken against price list violations in Khanewal district

DC chairs review meeting of DEG

Turkey accuses Israel's Netanyahu of using war 'to stay in power'

Pakistan ranked 5th most vulnerable country to climate change. Tirmizi

Nadal comeback ends in Barcelona Open second round

More Stories From World

-

Tesla asks shareholders to reapprove huge Musk pay deal

14 minutes ago -

Real Madrid exact revenge on Man City to reach Champions League semis

24 minutes ago -

German far-right firebrand in court for using Nazi slogan

24 minutes ago -

Gauff, Raducanu shine in Stuttgart

44 minutes ago -

Eight reported injured after Japan quake

44 minutes ago -

Error-plagued Gauff wins clay season opener, Raducanu shines

44 minutes ago

-

Tokyo shares open lower after US chip shares fall

44 minutes ago -

Ruling conservatives win most seats in Croatia election, but no majority

44 minutes ago -

US university cancels Muslim student's graduation speech after pro-Israel groups object, CAIR protes ..

2 hours ago -

EU weighs response to Russian 'interference' in election runup

7 hours ago -

Going 'backwards'? Whistleblowers slam Boeing safety culture

7 hours ago -

US to reimpose oil sanctions on Venezuela: officials

7 hours ago